Lenny Lender

Lenny Lender

Ready to pull the trigger

ON YOUR

REFINANCE?

If you are, so are we.

Ready to pull the trigger

ON YOUR

REFINANCE?

If you are, so are we.

You may have heard about refinancing and wish you knew more about it.

Refinancing a mortgage means paying off an existing loan and replacing it with a new one. There are many reasons why homeowners refinance:

A refinance loan is an option that is available to homeowners who have a mortgage on their home. Refinancing will consolidate your existing mortgage with a new loan and save you money on your monthly payments.

- To obtain a lower interest rate

- To shorten the term of their mortgage

- To convert the mortgage type

- To tap into home equity

You may have heard about refinancing and wish you knew more about it.

Refinancing a mortgage means paying off an existing loan and replacing it with a new one. There are many reasons why homeowners refinance:

A refinance loan is an option that is available to homeowners who have a mortgage on their home. Refinancing will consolidate your existing mortgage with a new loan and save you money on your monthly payments.

- To obtain a lower interest rate

- To shorten the term of their mortgage

- To convert the mortgage type

- To tap into home equity

Have

Questions?

If you're feeling trapped in a high interest rate loan, suffer with negative equity, or have other debtor credit obstacles that are preventing you from refinancing your current loan or preventing you from purchasing a new home, then it's time to call us!

Have Questions?

If you're feeling trapped in a high interest rate loan, suffer with negative equity, or have other debtor credit obstacles that are preventing you from refinancing your current loan or preventing you from purchasing a new home, then it's time to call us!

Free Up Cash And Save

Lower Your Payment

Even the slightest difference in your mortgage rate can impact your monthly payment. If you refinance to a lower interest rate, your monthly payment will likely shrink. You can put those savings toward other expenses or apply it toward your principal balance, which will help you to pay off your loan sooner.

Consolidate Debt

Homeowners often access the equity in their homes to cover major expenses, such as the costs of home remodeling or a child's college education. These homeowners may justify the refinancing by the fact that remodeling adds value to the home or that the interest rate on the mortgage loan is less than the rate on money borrowed from another source.

Save On Interest

The interest rate and the mortgage term, together, determine how much total interest you'll pay over the life of your loan. By reducing one or both of these factors, you could be saving a significant amount on interest in the long run.

Free Up Cash And Save

Lower Your Payment

Even the slightest difference in your mortgage rate can impact your monthly payment. If you refinance to a lower interest rate, your monthly payment will likely shrink. You can put those savings toward other expenses or apply it toward your principal balance, which will help you to pay off your loan sooner.

Consolidate Debt

Homeowners often access the equity in their homes to cover major expenses, such as the costs of home remodeling or a child's college education. These homeowners may justify the refinancing by the fact that remodeling adds value to the home or that the interest rate on the mortgage loan is less than the rate on money borrowed from another source.

Save On Interest

The interest rate and the mortgage term, together, determine how much total interest you'll pay over the life of your loan. By reducing one or both of these factors, you could be saving a significant amount on interest in the long run.

The dream of homeownership has always been at the very heart of the “American Dream”. We believe that homeownership is the foundation of financial security for aspiring families.

Compass Borrower Advantages

• New homebuyer tool kits

• Pre-qualifications

• Rent / buy analysis

• Comparative property - loan cost analysis

• Unique programs

• First time home buyer education

• Mortgage Do's and Don't

• Hablamos Español

• Any other mortgage related questions

Guiding you on the path to homeownership.

Let's Get Started

Lenny Lender

Mortgage Lender, NMLS# NMLS # 2067336

The dream of homeownership has always been at the very heart of the “American Dream”. We believe that homeownership is the foundation of financial security for aspiring families.

Lenny Lender

Mortgage Lender, NMLS# NMLS # 2067336

The dream of homeownership has always been at the very heart of the “American Dream”. We believe that homeownership is the foundation of financial security for aspiring families.

Let's Get Started

Meet the Agent

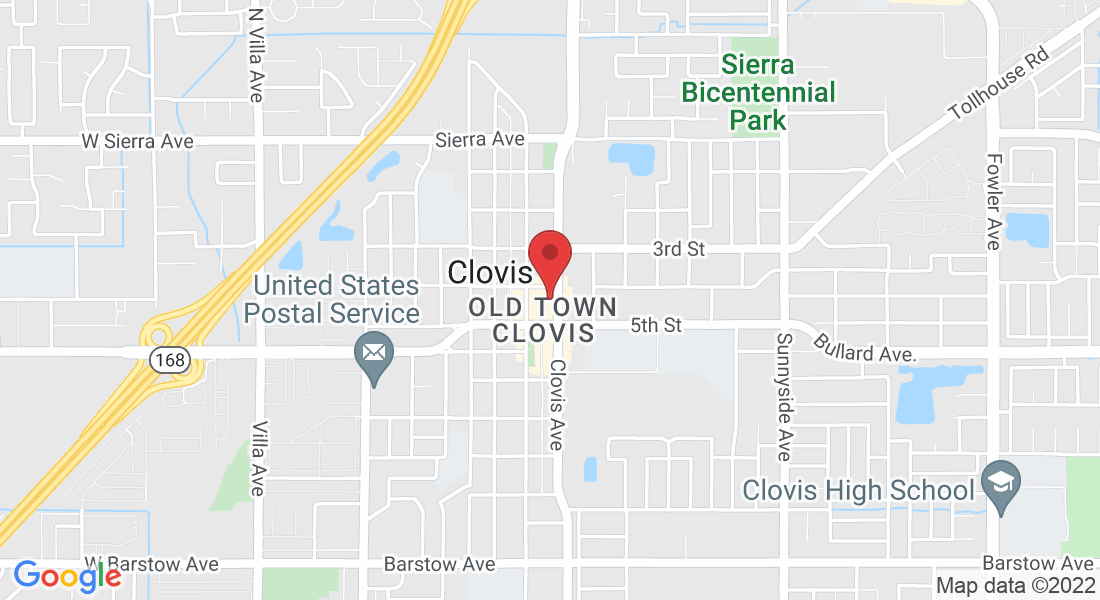

More Homes In Your Area

3 Bedroom / 2 Bath

Clovis Area Home

3 Bedroom / 2 Bath

Clovis Area Home

3 Bedroom / 2 Bath

Clovis Area Home

©2025 Home Possible Brokers Inc. - Corporate NMLSID #2324077 located at 418 Clovis Ave, Clovis, CA 93612. All rights reserved. DBA: Compass Mortgage Team. Licensed by the California Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act. Compass Mortgage Team strives for compliance with all applicable state laws and federal regulations pertaining to mortgage lending, advertising, and marketing laws. THIS PRODUCT OR SERVICE HAS NOT BEEN APPROVED OR ENDORSED BY ANY GOVERNMENTAL AGENCY, AND THIS OFFER IS NOT BEING MADE BY AN AGENCY OF THE GOVERNMENT. All applications are subject to underwriting guidelines and approval. This does not constitute an offer to lend. Not all applicants will qualify for all loan products offered. All loan programs, terms and interest rates are subject to change and/or discontinuance without advance notice. Equal Housing Opportunity. ©2025

" A hero can be anyone. Even a man doing something as simple and reassuring as putting a coat around a young boy's shoulders to let him know the world hadn't ended."

- Bruce Wayne

STEP 1

Praesent semper, lacus cursus porta, feugiat primis in luctus ultrice tellus potenti.

STEP 2

Feugiat erat a ipsum viverra, vel finibus est bibendum. Praesent commodo dolor a lorem.